AI-Powered Strategy Optimizer Tutorial

Video Tutorial: Immediate Value

Video Tutorial: Full Feature Tutorial

The Trading Strategy Optimizer is a versatile tool tailored for both non-coding traders and seasoned algorithmic trading professionals.

How To Optimize Your Strategy Without Code

Elevate your trading strategy with Kioseff Trading's AI-Powered Strategy Optimizer - designed for the discerning trader who demands precision and performance. Easily fine-tune your approach to harness the full potential of your market insight.

Build your strategy in the settings

Ensure that the indicator you wish to optimize is already applied to your chart. This enables the Trading Strategy Optimizer to interact with the indicator and finetune profit targets and stop losses effectively.

Sync your strategy with the Kioseff Trading AI-Powered Strategy Optimizer

This example uses the RSI indicator to initiate a long trade whenever it dips below the 30 mark.

Leverage AI Recommendations

Optimization Guidance

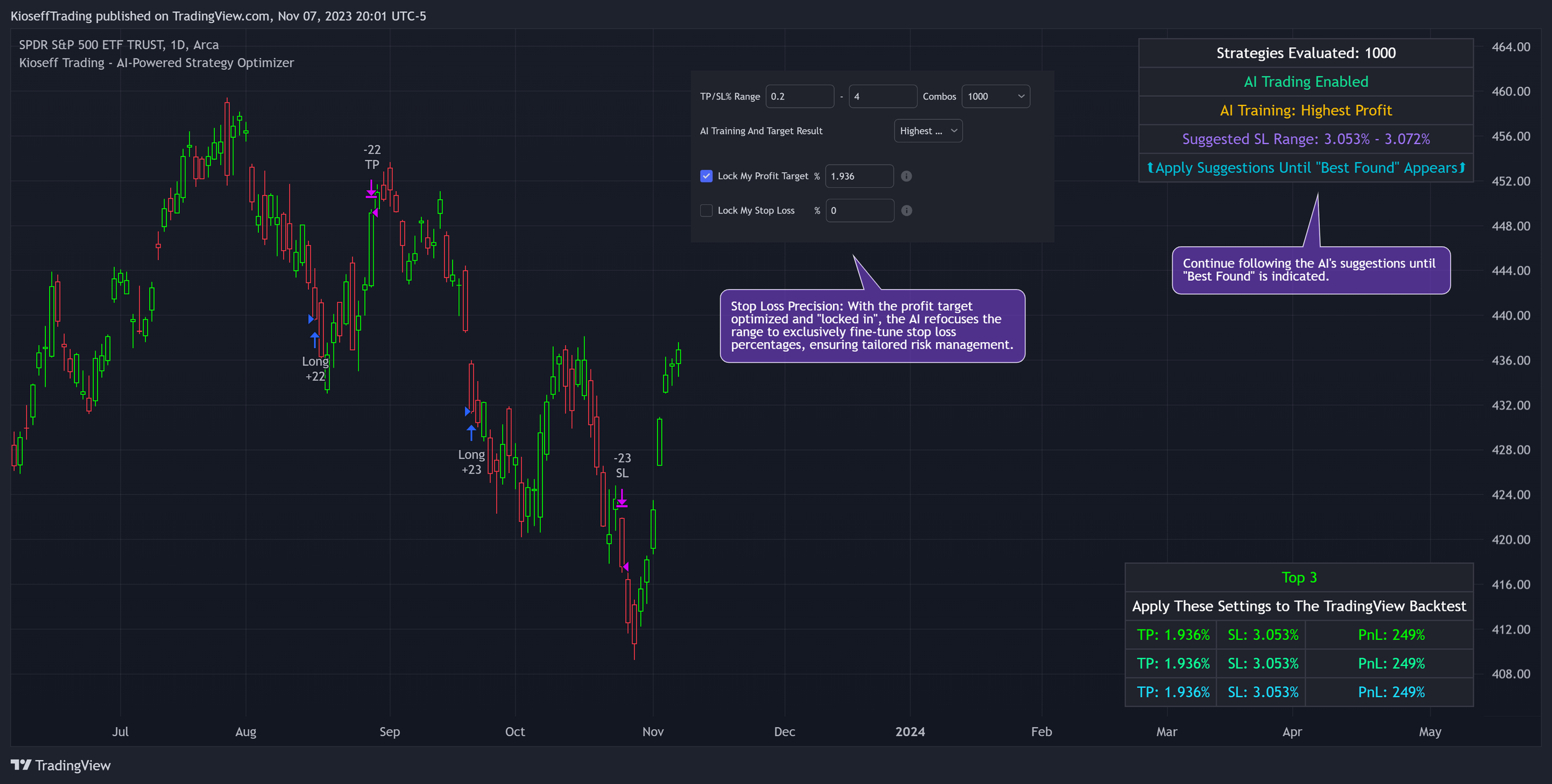

Upon initializing your strategy with our tool, you'll receive expert recommendations for fine-tuning your Take Profit (TP) and Stop Loss (SL) settings for enhanced results. This smart feature scrutinizes historical data to suggest the most effective TP and SL ranges for your strategy.

Adaptive Implementation

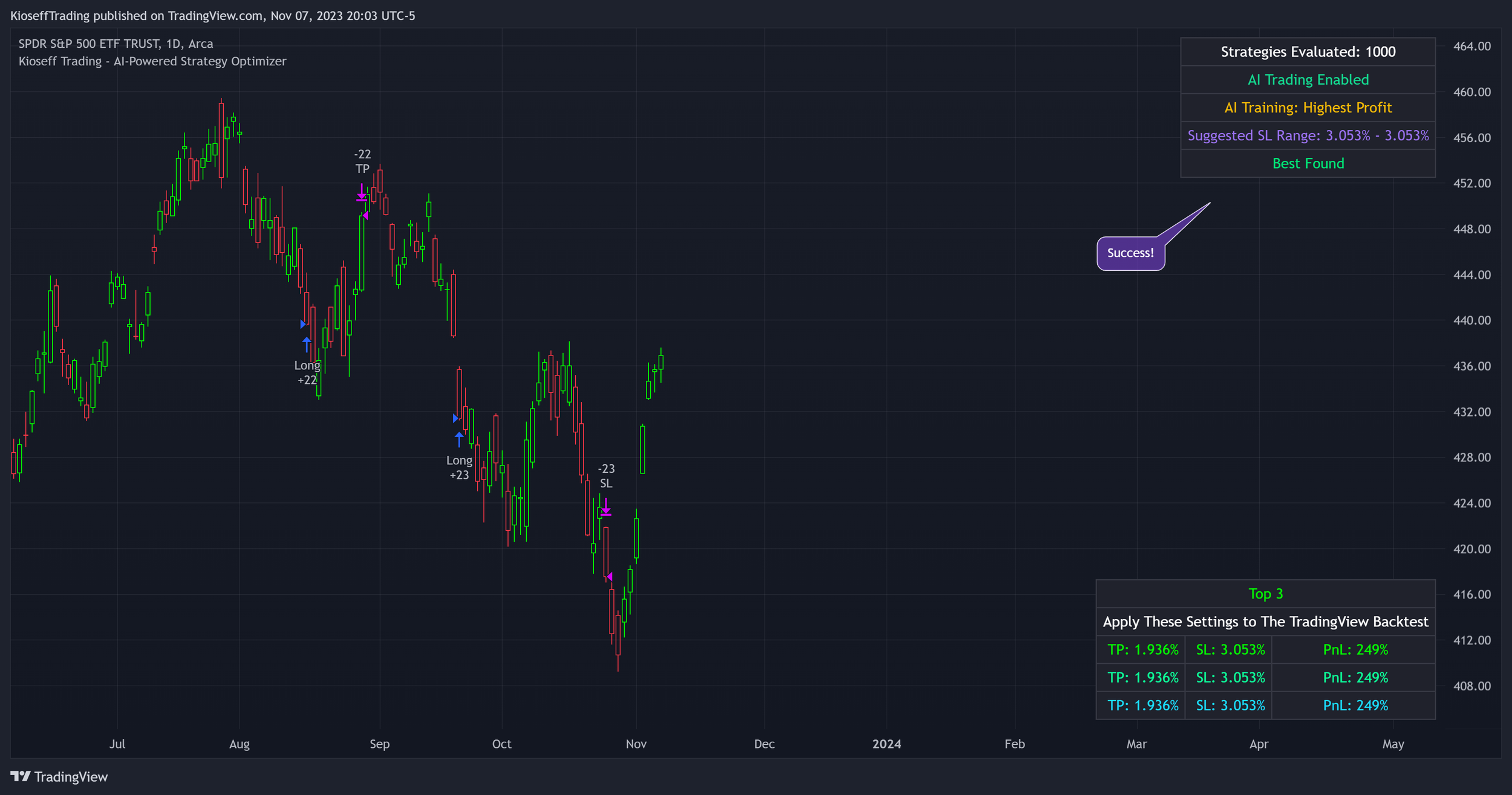

Adapt your strategy in real time by adjusting the TP and SL in accordance with the tool's ongoing recommendations. Continue this iterative process until the tool validates the optimal configuration with a "Best Found" notification.

Fine-Tuning for Precision

To further refine your strategy and unlock its full potential, expand the scope of testing with a broader range of combinations. This additional step is your pathway to a more customized and potentially effective trading strategy. Follow the AI's lead to elevate your trading precision to new heights.

Optimized Outcome

Upon completion, you'll be presented with the indicator's ideal settings. This conclusive snapshot reflects the culmination of a meticulous optimization process, ensuring that you're equipped with the most effective strategy parameters.

Pre-Optimization Performance

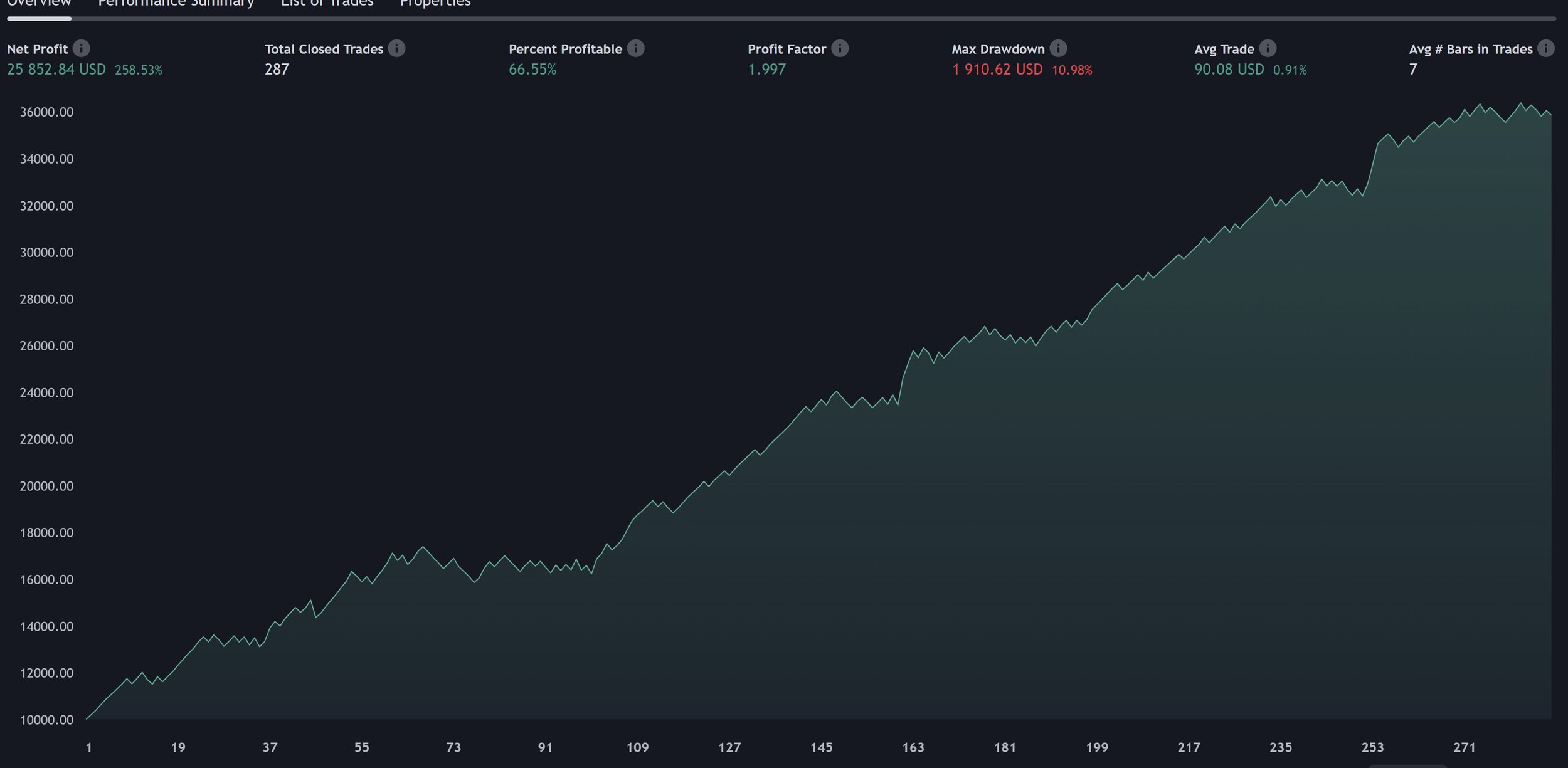

Optimized Performance

Next-Gen Fine Tuning (Optional)

Lock the Optimal Profit Target or Stop Loss to Further Fine Tune Your Strategy

Maximize Efficiency with Precision: Secure your prime profit target and dial in on stop loss settings to hone your strategy to perfection. Unleash the full potential of your trade plan with our optimizer's pinpoint accuracy.

Harness The Power Of AI

Experience the full potential of Kioseff Trading's AI-Powered Strategy Optimizer. With AI Trading active by default, the impressive results above speak for themselves. Dive deeper into the capabilities and see how you can customize the AI to suit your trading style.

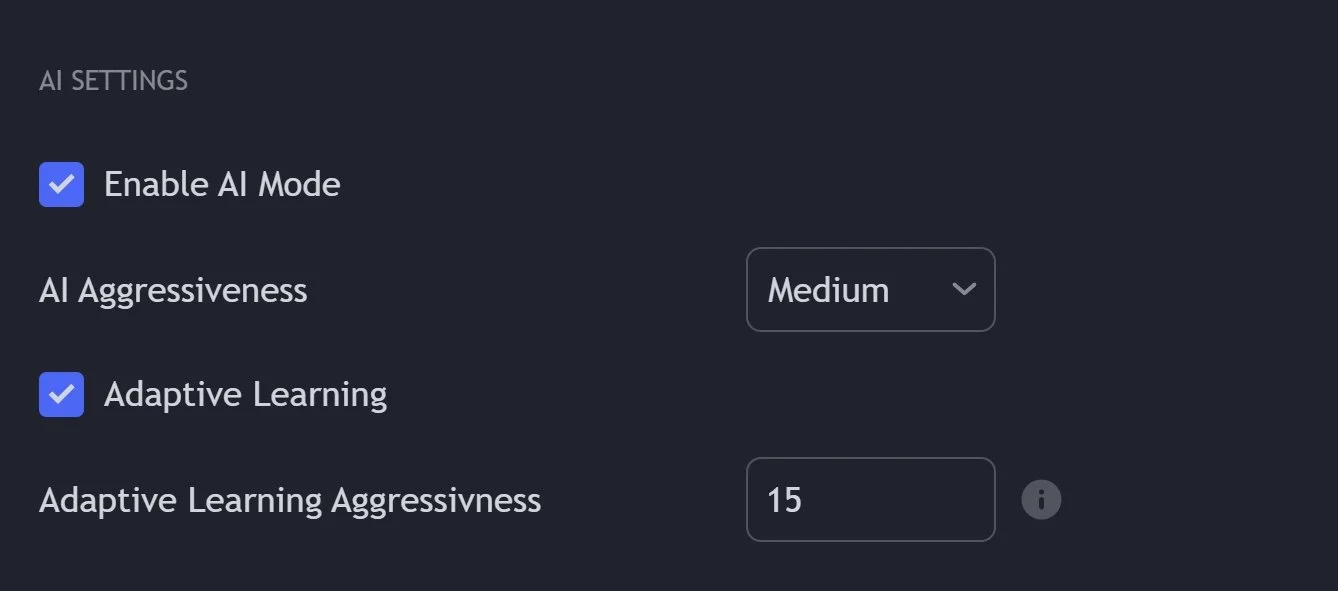

AI Mode

AI Mode incorporates Heuristic-Based Adaptive Learning to fine-tune trading strategies in a continuous manner. This feature consists of two main components.

Online Learning

The algorithm updates the performance evaluations of each strategy based on incoming market data. This enables the system to adapt to current market conditions. Incorporating both heuristic-based decision-making and online learning, this feature aims to provide a framework for strategy optimization.

Heuristic-Based Decision Making

The algorithm evaluates multiple versions of your trading strategy using specific metrics such as Profit and Loss (PNL), Win Rate, and Most Efficient Profit. These metrics act as heuristics to assist the algorithm in identifying suitable profit targets and stop losses for trade execution.

AI Settings Enabled

-

The "AI Mode Aggressiveness" setting allows you to fine-tune the AI's trading behavior. This setting ranges from "Low" To "High, with higher aggressiveness indicating a more assertive trading approach.

This feature filters trading strategies based on a proprietary evaluation method. A higher setting narrows down the strategies that the AI will consider, leaning towards more aggressive trading. Conversely, a lower setting allows for a more conservative approach by broadening the pool of potential strategies.

-

When Adaptive Learning is enabled, the "Adaptive Learning Aggressiveness" setting controls how dynamically the AI adapts to market conditions using selected performance metrics.

This setting impacts the AI's responsiveness to shifts in strategy performance. By adjusting this setting, you can control how quickly the AI moves away from strategies that may have been historically successful but are currently underperforming, towards strategies that are showing current promise.